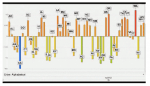

State unemployment insurance trust funds, the engines that finance jobless benefits for millions of Americans, were battered by the Great Recession and went deep into debt to meet the demand from the unemployed.

During good economic times, states aim to maintain large enough balances in the trust funds to pay benefits to jobless workers if unemployment spikes. If money is short, especially during deep recessions, states sometimes are forced to borrow in order to pay the benefits, or else they must slash benefits or otherwise cut costs.

During the Great Recession and its aftermath, many states were forced to borrow and cut benefits. Some with high levels of debt have made permanent changes to reduce the number of weeks of unemployment benefits available, to levels not seen since the 1935 Social Security Act established the program.

“The poor trust fund position of a number of states is the driving force that’s causing the restriction of benefits that’s going on,” said Wayne Vroman, a senior fellow at the Urban Institute. “The fact of the crisis as reflected in the trust fund debts is reflected in the benefits.”

Chosen excerpts by Job Market Monitor. Read the whole story at Unemployment Insurance Trust Fund Debts Squeeze Jobless Benefits.

Related article

Discussion

Trackbacks/Pingbacks

Pingback: Unemployment Insurance Trust Funds in US in Chart | Job Market Monitor - May 26, 2014

Pingback: Unemployment Insurance Extension in US – Update | Job Market Monitor - May 30, 2014