Michael Greenstone and Adam Looney of The Hamilton Project – Brookings Institute examine the progressivity of the U.S. tax code and highlight two facts:

- the current U.S. tax system is less progressive than the tax systems of other industrialized countries, and

- considerably less progressive today than it was just a few decades ago.

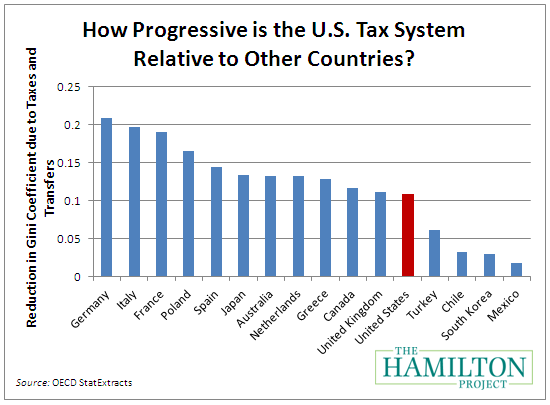

The figure below shows how much influence taxes and transfers have in reducing inequality (measured using a common metric called the “Gini coefficient”) in various countries around the world. As indicated in the chart, the U.S. tax and transfer system does less to counteract pre-tax income inequality than the tax systems of most of our peer countries, meaning that our system is actually less progressive.

.

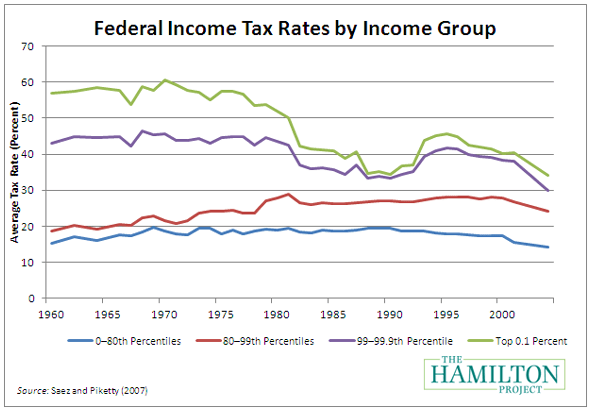

In addition to being less progressive relative to other countries, the U.S. tax system has also become less progressive over time. Over the last fifty years, tax rates for the wealthiest Americans have declined by 40 percent, while tax rates for average Americans have remained roughly constant. This is illustrated in the figure below.

.

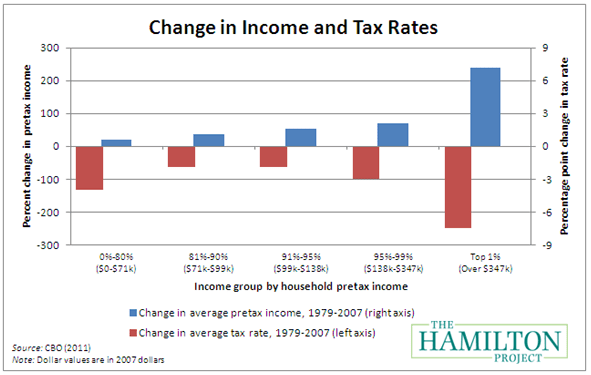

This decline in tax rates for the wealthy has coincided with an increase in income inequality, where most of the wage gains have been concentrated among a relatively small portion of the American people. For example, since 1979, earnings for households in the top 1 percent of the income distribution have risen by over 250 percent. At the same time, many households at the middle and bottom of the income distribution have experienced stagnating incomes or even declines in earnings (figure below, blue bars). This means that the very people who have received the biggest income gains in the past three decades have also seen the largest tax cuts (figure below, red bars).

.

These estimates may come as a surprise to observers focused on the share of federal taxes paid by high-income individuals, rather than the tax rates that those individuals face. Without a doubt, the share of taxes paid by high-income individuals has increased. But the reason why the share of taxes paid by the top 10 percent has increased is because their share of income has increased.

Source: Adapted excerpts by Job Market Monitor from

via Just How Progressive Is the U.S. Tax Code? – Up Front Blog – Brookings Institution.

Reblogged this on ZYNKIN NEWS and commented:

I wonder what this article will read like in a years time or Less!

Posted by Z | October 19, 2012, 8:16 amHey there, You’ve done a fantastic job. I will definitely digg it and personally suggest to my friends. I am sure they will be benefited from this website.

Posted by Maybelle | April 10, 2013, 6:50 am